When Does the Fed Meet Again

As had been widely expected, the Federal Reserve appear it would go on its benchmark interest rate nigh naught when it concluded its ii-solar day meeting of policymakers on Wednesday. Language in the Fed's post-meeting statement indicated for the offset time that it will outset withdrawing some of the emergency financial support for the economic system.

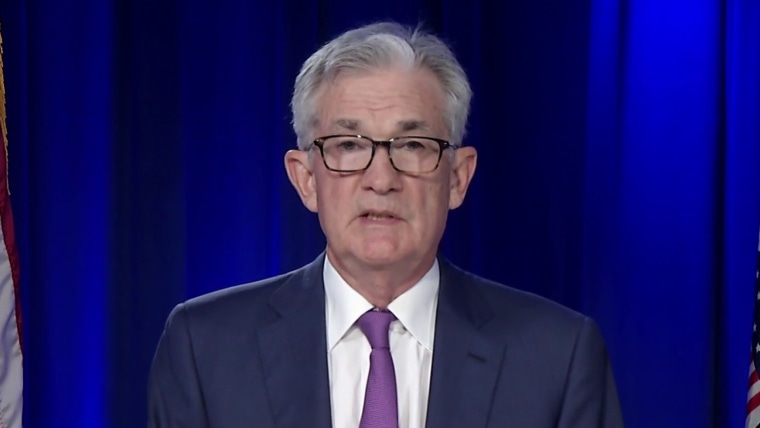

Federal Reserve Chairman Jerome Powell said that the central banking concern could brainstorm the process of scaling down its pandemic-era bond-buying programs, although he did non commit to a date.

"If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may shortly be warranted," he said in a prepared statement.

At the start of the pandemic, the Fed committed to purchasing an open-ended corporeality of U.S. Treasury and mortgage bonds, which has provided much-needed stimulus through the worst of the Covid-xix recession. Wall Street had been expecting a signal of this tenor, with market place participants anticipating a formal annunciation about the wind-downwards following the Fed'due south November meeting.

Powell'south messaging has been excruciatingly calibrated to avert spooking markets: The Fed Chair is eager to avert a repeat of the and then-called "taper tantrum" of 2013, when Wall Street was surprised past the Fed's decision to curtail its Great Recession-era bond-buying, triggering a market drop.

Consumers are seeing prices go up for gas, nutrient, rent and restaurants — and they feel inflation is a real thing, whether the data shows information technology or not.

As such, the chat around scaling back these purchases is one that consists of many steps and will unfold over a period of months, market observers say.

"They took the path of hinting at it, and delicately talking virtually it, and the markets accept really adjusted to that," said Dan North, senior economist at Euler Hermes North America.

Wall Street expects the winding-down process itself to take place over half dozen to 12 months, said Craig Fehr, principal and investment strategist at Edward Jones. "A shorter timeline might raise the anxiety level a little flake," he said.

Powell took pains Wed to decouple the bond taper from a rate increment, emphasizing that the ii activities are not linked and that the threshold for raising interest rates is considerably college than for scaling dorsum emergency liquidity measures. He acknowledged that policymakers have differing perspectives when information technology comes to the commencement engagement also as the speed of rate hikes, but played down the diverging viewpoints of officials.

There is "not really an unusually wide assortment of views near this," Powell said, pointing out that only a single committee member thinks interest rates will all the same be at their current near-zero rate by the terminate of 2023, with a plurality expecting an increase merely effectually one percent at that point.

An increasing number of Fed officials accept expressed more than hawkish viewpoints — an outlook that has evolved over the summer as the labor market began to show signs of comeback and inflationary metrics rose. For these policymakers, worry about pockets of aggrandizement becoming entrenched overshadows business organisation that dent policy accommodation will weaken the economic system.

Economists bespeak out that 1 of the trickiest things about aggrandizement is that it can be fueled past sentiment and expectations more than actual macroeconomic data.

"For consumers, they know what they see and they know that they're seeing prices go upwards — they encounter gas and they see nutrient and they run across rent and they see restaurants," said Tom Martin, senior portfolio manager at Globalt Investments. "The feeling is that inflation is a existent thing and volition probably last longer than the Fed is saying. It'south in the Fed'south best interest to talk down those risks."

Worry over the economical impact of the delta variant and market jitters nearly the showdown in Washington, D.C., over the debt ceiling have besides injected a note of doubt that Fed officials and investors akin must navigate.

In response to press questions, Powell urged Congress to enhance the debt ceiling and non risk the U.S. dollar'southward status as the world'southward reserve currency, a position also forcefully expressed past Treasury Secretary Janet Yellen, and demurred on a question nearly the possibility of being reappointed by President Joe Biden next twelvemonth.

Powell also fielded questions near the revelation that two regional Fed Presidents had held or traded avails concluding year whose prices could accept been influenced by the central banking concern's activities. He said he hadn't known that Dallas Fed President Robert Kaplan or Boston Fed President Eric Rosengren had engaged in these activities, maxim, "I was not aware of the specifics of what they were doing."

He reiterated his commitment to a "comprehensive review" of the bureau'southward ideals rules and prohibitions, saying this was necessary to maintain the Fed'south reputation of independence and public trust in the institution. "The trust of the American people is essential," he said.

On the subject of cryptocurrency, Powell said the central banking company is studying whether or not to develop a digital currency, with a paper on the topic nearly completion, he said. When asked if the U.S. risked falling behind other nations' digital-currency intitiatives, Powell expressed satisfaction with the Fed's current stride. "Information technology's more important to do it correct than practise it fast," he said.

hornsbyyousyllook1998.blogspot.com

Source: https://www.nbcnews.com/business/economy/what-watch-fed-s-latest-meeting-n1279819

0 Response to "When Does the Fed Meet Again"

Post a Comment